Are Car Accident Settlement Calculators Accurate?

Car accidents happen all the time in our country. It doesn’t take much for someone to be negligent while they’re driving. That means you can be the best and safest driver with no history of accidents, but it can still happen. You can’t control how other drivers behave on the road. You can’t stop them from eating, texting, or being distracted. So, when an accident does happen, how do you handle it? Who do you call first?

Immediately after the car accident, if you’re able, the first thing you would do is contact the police. From there, they would help you get checked out if there’s an injury. If you’re not injured, then you should do your own task of taking photographs of the scene, getting witness testimonies, and exchanging information with the person you are in an accident with. Once you exchange information with them, you would then file a claim with their insurer. If you are unsure of the next steps after filing a claim contact your personal injury attorney.

Especially if there’s an injury, you might be thinking whether the best idea is to take your claim to court. You want as much money for damages as you can get. This is especially true if your injury causes you to miss time at work. Time off work means you’re not getting paid due to no fault of your own. Someone else was negligent and you got hurt. Or, your vehicle was damaged or even totaled, preventing you from getting around.

The reality is, that very few car accident cases actually make their way to trial. Usually, the insurance companies will negotiate and do their best to settle the dispute. The other person might contact your insurance company to try and get damages for their vehicle even if they were at fault. The two insurance companies might battle it out and try to settle that cost as well. They might determine between themselves who was at fault.

Basic Information on Car Accident Settlements

As stated above, it’s not common for car accident cases to be taken to the courts. This is even for injury or vehicle damage claims, as most of these cases are heard and settled by the insurance companies before it get to that point. Even if someone doesn’t like the claim or the settlement that they receive, and they wish to file a claim against the person who hit them, it is still more likely that that situation would be settled before any trial takes place.

This is why it’s super important for drivers to understand how insurance claims are handled by insurance companies. They will work their hardest to ensure that some type of settlement occurs. Typically, a settlement is when both sides agree to compromise about who was at fault and agree to the payout offered. In many incidences, a settlement allows for neither side to admit wrongdoing. They receive their settlement, shake hands, and walk away.

This doesn’t mean that a lot of misunderstandings can’t happen. As the insurance companies try to create a settlement, you might not be happy with the other person’s insurance company trying to give you a low offer to make the claim go away. They will offer their own assessment, quote, and/or estimate. They may even try to pin the accident on you any way they can. The next step would be for you to write their insurance company a demand letter.

What’s a Demand Letter?

Once you get into an accident with someone, you will exchange information. Once you get the insurance company’s information, you will send them a claim for injury and/or damage claims. They themselves will put together an estimate and send that to you. You have the option of accepting their estimates, but oftentimes they will try to get you into settling at the lowest possible number they can.

If you’re not happy with their quote, you have the option of further explaining to them why you need more money. This is called a demand letter. You would send a demand letter to the insurance company further explaining the injury and/or the damage you and your vehicle received during the accident and why you don’t feel the quote quite covers your experience. Make your demand letter as detailed as possible.

Within this demand letter, you would also request from them a new amount that you believe is fair. Maybe you got a different quote on the full cost of repairing the damages or your entries will leave you out of work for an extended time. Either way, you don’t think their offer was fair, so you send a new offer back to them. From there, the different parties would discuss your new offer and send you a new quote. This is the negotiation until a resolution is reached on all sides.

Negotiations to Resolve a Dispute

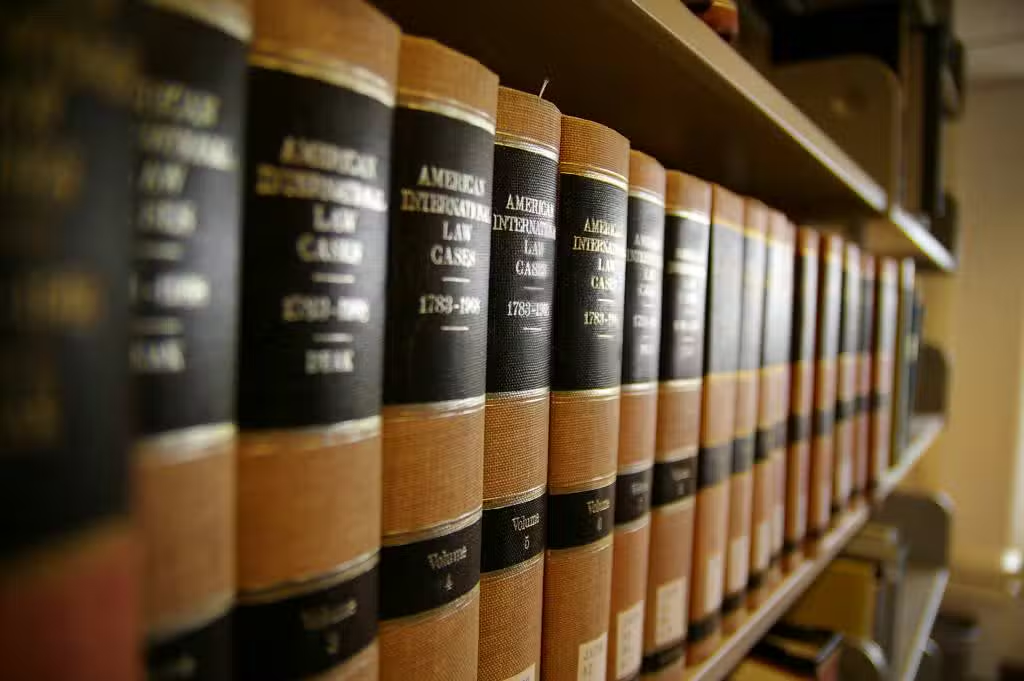

If the negotiations don’t seem to be going anywhere, and you’re not happy with the numbers they keep sending back to you, you have options and seek legal counsel. This is considered having a mediation from a third party who is not invested in the case. They’re often licensed attorneys, but you are not really taking the claim to court. You would want them to provide guidance to both sides on what’s going on and what is reasonable.

If this doesn’t work in a negotiation cannot be reached, then the case might be taken to court to help settlement. Even if it’s taken to court, it’s still rare that an entire trial will take place. Often times the insurance company will still seek a resolution to prevent a court case from happening. This is why it’s really important to do your due diligence after an accident has happened.

Get eyewitness reports, take as many photographs as possible, and even get the police report. All these things can work in your favor when negotiating with an insurance company. All the evidence works in your favor, and the negotiation period should be fairly short. If not, then you have what you need to take the insurance company to court to get the settlement you feel you deserve.

What Is Diminished Value?

If you are involved in a traffic collision, and if you file a property damage claim to have your vehicle repaired, you may be leaving money on the table. This is a where an Atlanta car accident law firm can help.

In the state of Georgia, if your vehicle is damaged after a collision and you have the vehicle repaired – that is, the vehicle was not a total loss – you have the right to a property damage claim for repairs, but you also have the right to a “diminished value” claim.

How Do Diminished Value Claims Work?

Diminished value is a second damage claim that you have if your vehicle is repaired after an accident. If your vehicle is a total loss, you will not have a diminished value claim, but you will instead have a claim for the market value of your vehicle at the time of the collision.

On the other hand, if you have the vehicle repaired, you have a right to make two claims:

- a claim for the repair of the vehicle, which should completely cover your repair expenses

- a claim called “diminished value”

How is Diminished Value Defined and Determined?

Here’s what diminished value is. Think of CARFAX, which maintains a comprehensive vehicle history database using information from every state’s Department of Motor Vehicles. When you sell a vehicle, anyone can find the vehicle on CARFAX to determine if it has been in an accident.

Naturally, even if a vehicle looks and runs great if a potential buyer knows that the vehicle has been in an accident, you will be offered less than you would be offered for the same vehicle if it had never been in a collision.

In other words, a collision automatically diminishes the value of a car, truck, or SUV. It doesn’t even matter if the repairs make a vehicle better than new – simply being in an accident reduces its worth.

Every driver in the state of Georgia should know about the right to make a diminished value claim. Every year, thousands of people in our state simply leave money on the table. It’s the equivalent of handing over your cash to an auto insurance company for no good reason.

What Does the Law Say About Diminished Value Claims?

Some automobile insurance companies in Georgia may tell you that diminished value is set by law at ten percent of the cost of the repairs. That simply is not what the law says. It is merely what some insurance companies tell some consumers because it’s the easy thing to do.

In fact, what you have is a right to the market value difference between a vehicle like yours that has never been in a wreck and your own vehicle after it has been in a wreck. Sometimes, the real diminished value of a vehicle after an accident can be a thousand dollars or even more.

Diminished value, however, can be difficult to determine fairly and accurately, so you may have to hire a diminished value expert. Google “diminished value,” and you will find plenty of diminished value experts here in Georgia.

When Should You Hire a Diminished Value Expert?

If an auto insurance company offers you only one or two hundred dollars for diminished value, but you believe that your diminished value claim may be worth far more, you will have to decide if hiring a diminished value expert is worth it in your own case.

At a minimum, you should negotiate an insurance company’s first offer for diminished value.

Do not accept the first offer – it will almost always be an offer that is far less than the actual worth of your diminished value claim – and do not let them tell you that ten percent of the repair cost is all that the insurance company is required to pay you for diminished value. It isn’t.

If a Negligent Driver Damages Your Vehicle, What Should You Do?

When an at-fault driver damages your vehicle in an accident, that driver’s insurance company should pay you for the full amount of your vehicle’s diminished value. That’s the law, but it is up to you to make the claim, negotiate, and in some cases, hire a diminished value expert.

There is utterly no reason for you, in effect, to give an insurance company money that is yours.

In most cases, you should be able to file and negotiate property damage and diminished value claims on your own. Vehicles can always be replaced. You can’t.

What if You Are Injured by a Negligent Driver?

If you are injured by a negligent driver in Georgia, take your case at once to an experienced Atlanta personal injury attorney. Because your health and your future are so much more important than any car or truck, you will need to let an attorney handle a personal injury claim.

Injured victims of negligence in this state are entitled to full compensation for their medical expenses, lost wages, personal pain and suffering, and all related losses and damages – as well as property damages and diminished value.

If you are injured by a negligent driver in Georgia, and if your health and your future may be at stake, you will absolutely require the representation and sound legal advice that an experienced injury lawyer will provide.

What Does It Cost to Learn More?

Georgia’s accident attorneys offer a free, no-obligation first legal consultation to the injured victims of negligence, so it will not cost you a thing to learn more.

An Atlanta personal injury attorney will offer you trustworthy legal advice and will fully explain your legal rights and options. If you have a personal injury claim, and if you choose to move forward with it, your attorney will fight aggressively for the compensation you need.

If a negligent driver has injured you, has damaged your vehicle, or both, you are entitled by law in the state of Georgia to full compensation. That is your right. An attorney’s help is also your right. There is no reason for you to leave money on the table.

Is Biker Profiling An Issue?

As a Savannah motorcycle lawyer, there’s a certain issue that we are aware of in the motorcycle community, and it is biker profiling. However, there’s a particular angle to this profiling of bikers that is most of what we see in the field, and that is profiling by police officers and other government entities and assuming all bikers are in gangs.

The Profiling Issues That Bikers Deal With Daily

For example, If you’re in a motorcycle club, that means you’re a gang member. While profiling for bikers is an important issue, I think there’s an even more subtle form of profiling that’s going on with motorcycle riders.

Here are some specific examples that have me so agitated right now. Unfortunately, motorcycle riders have to police themselves and do everything they can to project an image to the general public that helps with this profiling concept.

What I’m referring to is this subtle underlying theory, if you will, by the general public that doesn’t ride, that motorcycle riders are the ones that are always doing something stupid.

They’re driving fast, and they’re the ones that are always at fault in car wrecks and things like that. That’s the subtle profiling that then is pervasive throughout the system.

How Insurance Companies Use Motorcycle Rider Bias To Their Advantage

I’ve mentioned in that past about jurors and how my biggest fight in what I do on a daily basis in my practice is fighting against this profile because the insurance companies use it to their advantage. They know they’re going to get 12 jurors that are going to have this underlying theory and thought about motorcycle riders.

They prey upon it in cases where there shouldn’t be arguments of fault and all of sudden there is in almost every motorcycle case. This is because they know they can prey upon this bias that maybe the motorcycle rider was doing something wrong and they’re partially or totally responsible for the wreck.

What does that do? If it’s partial, it lowers the recovery that you can get for your injuries. You wouldn’t even have that discussion in a lot of these cases if it was a car vs. car wreck, but for some reason, it’s always an issue in motorcycle cases.

Real Life Examples Of Biker Profiling In Accident Cases

Here’s some examples I have dealt with. I had a guy call the other day that was in a wreck where the car pulls out and T-boned the motorcycle rider. Clearly at fault for the accident, how can you argue otherwise?

He gets out of the vehicle and is immediately complaining to the cop that, “Oh, well, I think the motorcycle rider must have been speeding.” He’s got no evidence of it but says somehow the motorcycle rider was speeding. He wouldn’t even be making those arguments if it was a car.

I’ve got another example where a lady T-bones my client at night, going through a lane—his lane, to get to a convenience store. She’s totally not paying attention and is 100 % at fault.

What does she do? She gets out and says, “Oh, he was probably drinking, probably didn’t have his headlights on.” Well, we’re able to prove, with witnesses, he had his headlights on. She’s coming up with every excuse possible to say, “I’m not at fault, the motorcycle rider is.”

Again, you don’t even see this in most car wreck cases, but somehow, every single time it’s happening in motorcycle cases that I see.

I had one that we’re still working through that was delayed for two months because the guy rear-ends a motorcycle rider who is stopped at a stop sign waiting on traffic so that she could go.

He hits her, knocks her off her bike, admits fault at the scene to like 12 different witnesses, but guess what? To his insurance company, he then says, “No I wasn’t at fault.” He comes up with some excuse that she was out in the roadway, not where she says she was.

This took two months of us fighting that concept with the witnesses and more to get the insurance company to back off of their insured’s excuses for what happened.

What Can Be Done To Stop This?

Again, we don’t have this in 99% of car vs. car cases, but yet, every single motorcycle wreck case that we have received and are working on, it’s excuse after excuse.

To put it simply, this is subtle profiling, and I want to keep you aware of it because it doesn’t get as much attention and it needs to. It’s way more pervasive than the profiling that’s in the headlines about police officers harassing bikers because of this concept that their all drug runners and in gangs.

It is still a huge problem, don’t get me wrong, but here’s another aspect to it.

Finally, look at the organizations that are pushing two bills. There’s been this national push to get laws created around this profiling of bikers and to try to relieve this issue. There are two bills, one in the house, one in the Senate.

As a Savannah motorcycle lawyer, with every single motorcycle wreck case that I’ve received, we’ve got an at-fault party who’s dead to rights at fall. Yet, they are jumping out screaming to the hilltops and to the cops that they aren’t at fault. The motorcycle rider must’ve done something, didn’t have headlights on, must have been speeding, etc.

I had one case where the other driver had no clue what happened and shouted to the cop, “Oh, he must have been drunk.” So, they tested my client, and he wasn’t drunk.

Why All Motorcycles Should Come With Cameras

Out of that frustration, this got me thinking a bit more, but it seems to me that our cameras should come as standard equipment on all motorcycles at this point. They could even be go-pros on the front, on each side, and the back, and they should automatically start recording when you turn that key.

This would help capture these motorcycle wrecks where people are driving around, not paying attention and not seeing motorcycle riders when they clearly should. I can’t tell you how many of my cases are in broad daylight because of a driver doing something completely insane.

Truthfully, I think they don’t see the motorcycle rider, but it’s not because they’re looking but because they’re following Georgia law. In fact, I know some of the newer helmets are coming with cameras.

I don’t know how comfortable they are, but I know they are fantastic. I’m not sure if there’s a quality issue, but do anything you can do to mount a camera at least pointing out the rear and out the front.

Where Should The Cameras Be?

Most of these accidents are vehicles coming from your left, either directly in front of you or they’re coming and T-boning. So, a front camera would capture most of the negligence in that case.

The sides are going to be difficult to mount a camera, and I know it doesn’t look great, but it would be extremely beneficial in the event of a crash and once and for all, this silliness over who’s at fault will be done.

Is Georgia A No-Fault Auto Insurance State?

Is Georgia a “no-fault auto accident” state? What exactly is the difference between a “fault” state and a no-fault state?

What kind of automobile insurance are drivers required to carry in Georgia? And what are your rights if you are injured in a traffic crash in this state because another driver was negligent? Can a car accident attorney in Cumming, GA help?

What Insurance is Required for Drivers in Georgia?

Because Georgia borders Florida, and Florida is a “no-fault” state, people are sometimes confused about auto insurance in Georgia, but there is no need to be.

Georgia is a fault state. You will learn what that means and how auto insurance works in fault states like Georgia.

By law, motorists in Georgia are required to carry at least this much liability insurance coverage:

- $25,000 for an individual’s injury or death in an accident

- $50,000 total for more than one injury victim or death in an accident

- $25,000 of property damage coverage

In a no-fault state like Florida, your own auto insurance automatically covers your property damage, medical bills, lost wages, and your personal pain and suffering after a traffic crash, without regard to which driver was at-fault in the collision.

How Does Insurance Coverage Work in a “fault” State?

But you don’t have that automatic coverage in a fault state like Georgia. If you have been injured, to recover damages from an at-fault driver for either property damages or personal injury, you must prove that the other driver was in fact at-fault.

It’s actually even more complicated than that. Georgia uses the “modified comparative fault” rule for assigning liability in traffic collisions. To collect any damages from an at-fault driver, you have to prove that you are yourself less than fifty percent at fault for the accident.

Thus, the other driver’s auto insurance will only cover your damages if that driver is fifty-one percent or more at-fault for the accident and then only for the percentage of fault assigned to them. Thus the hope is the other driver is at fault and is 100% at-fault for the accident.

That should not be a concern for most injury victims after most traffic accidents because in most accidents, a single driver is one hundred percent at fault; that is almost always the case in a head-on, rear-end, and “t-bone” collisions.

How Can “Modified Comparative Fault” Work?

But if you have any fault of your own in a collision, your damages will be reduced by your percentage of fault. Let’s say, for example, that you are t-boned by an intoxicated driver who runs a red light, but you were speeding about seven miles per hour over the posted limit.

In such an example, you might be considered ten percent responsible for the accident because you were moderately speeding, so if your total injury claim amounted to $10,000, it would be reduced by ten percent, and you could receive no more than $9,000 in your recovery.

Who makes that determination? It would be a jury, and only after considering the facts in a personal injury trial.

The other driver’s insurance company might claim that you were partly at-fault in an accident, but if no settlement of the case can be reached, the final decisions are made only by a jury.

How Can You Prove Fault?

These cases can be complicated because Georgia is a fault state, which puts the burden on you, when you file a personal injury or property damage claim, to prove that you were less than fifty percent at-fault – and that the other driver was more than fifty percent at-fault – for the accident.

How do you prove that another driver was at-fault in a vehicle collision? In traffic accident cases, the police accident report is often a key, central piece of evidence, and one or more of the officers who responded to the accident may even testify in court regarding fault.

Other witnesses, video evidence, and other physical evidence can also be used to prove fault. If the police found open containers of alcohol in the at-fault driver’s vehicle, for example, that would be “physical” evidence of fault.

What Can an Injury Victim Receive?

In Georgia, if you have been injured by an at-fault driver, how much can you expect to receive in an out-of-court settlement or a jury verdict? There’s no one-size-fits-all answer. Every case is different.

Compensation payments are based on the extent of the injuries and damages, and your compensation may be reduced if you are found partially at fault for the accident.

When Should You Take Legal Action?

If you’re a driver who is involved in a traffic collision in Georgia, you will have to report the accident at once to your automobile insurance company, and you will probably also need to submit an insurance claim.

Georgia’s statute of limitations for filing a personal injury lawsuit – the amount of time you have to bring legal action after you’ve been injured or suffered property damage – is two years (from the accident date) for a personal injury lawsuit and four years for a property damage lawsuit.

You do not want to wait two years to file a personal injury lawsuit. You want instead to put your attorney to work as quickly as possible.

How long will it take to resolve your claim? Once again, there is no way to say, because once again, every case is different. Most claims, however, are resolved in just weeks or within a few months at most, and most claims are resolved privately, without the need for a jury trial.

But when fault is disputed in a personal injury case, or if an automobile insurance company simply refuses to act ethically and instead operates in “bad faith,” a final resolution of your case could conceivably take longer – even several years – and include a jury trial.

What Do the Numbers Tell Us About Accidents in Georgia?

In 2015, the average number of traffic accidents reported every day in this state surpassed one thousand. More than 1,400 traffic fatalities and 19,000 serious traffic injuries were reported in Georgia that year.

As the statistics show us, it’s easy to get injured in a traffic crash in this state. Succeeding with a personal injury claim, on the other hand, isn’t always so easy.

If the evidence supports your claim, and if you are represented by a skilled Atlanta car accident attorney, you’ll be in the best position to receive compensation for your injuries and damages after an accident.

After sustaining an injury in a traffic accident, if you have any questions or concerns regarding your rights or about obtaining the compensation you deserve, speak at once with an experienced Cumming car accident lawyer. Having a good attorney’s advice and guidance is your right.

Georgia Lemon Law And Motorcycles

Georgia’s Lemon Law is another example of how motorcycle riders are treated differently than ordinary, four-wheel vehicles and the general public, not only by the public but also in the law itself.

Keep reading to see what our Cumming motorcycle lawyers think about the subject.

What Is Georgia’s Lemon Law?

Now, I’m no lemon law expert. I do not practice lemon law, but what I had found surprising is in Georgia, the lemon law expressly excludes motorcycles, with no rhyme or reason to it.

Lemon law applies to all other four-wheel vehicles and explicitly excludes motorcycles, which I found pretty shocking. This has some big ramifications.

Recalls Vs. Lemon Law

I talked to a member of my Facebook group a few months ago about the video I had done regarding the Harley Davidson recall, which was the clutch recall. We got into a little bit of discussion of the difference between a recall like that that surrounds a manufacturing defect and lemon law.

When it comes to manufacturing defects and things like that, you obviously have a right to a claim when you have a motorcycle that has been manufactured in a defective way. But what about the lemon law?

The whole reason for lemon law was to cover the gap in Georgia law between a manufacturer’s duties and responsibilities. Once that vehicle is resold, motorcycles are no different than four-wheel vehicles.

I don’t understand why there is this difference out there in Georgia law, but I wanted to bring that to your attention because I found it quite shocking. I didn’t know it myself until I saw it. Then, I looked it up to confirm, and sure enough, it’s right there in the statute.

Use Caution When Buying A Motorcycle

Be careful out there when you’re purchasing a motorcycle. Georgia lemon law does not protect you in the purchase of that vehicle. Again, I’m no lemon law expert, but that seems like it’s leaving a huge gap out there.

In this article, my Savannah motorcycle accident law firm wants to give you a legal tip in case you are injured in a motorcycle accident or quite frankly, even if it’s in one of your everyday vehicles.

Does The Hospital Scam Injury Victims?

We’ve seen this in the past couple of years and here’s the scenario. You get injured, you’re transported, or you go to the hospital yourself to get treatment right after the accident.

You obviously let the nurse and the hospital administration staff know that it was because of a wreck. And then immediately you start hearing from them that you need to fill out this form or that form.

Then they tell you, “If it’s a wreck, we don’t take your health insurance. We bill it to the at-fault party.” This is why this works so well because to the everyday person, especially people who have not been in a wreck before, that makes a lot of logical sense.

Why Is This A Scam?

The at-fault party does not pay this bill right away. The insurance company for the at-fault party doesn’t pay the bill.

The insurance company pays you a settlement or a or pays your verdict. That will include potentially that bill, but they’re not going to pay it up front. It is your responsibility to pay that bill.

They’re doing this because sure they’ll send it to the auto insurance company for the at fault, but they know they’re not going to get paid by it. Then they turn around behind your back within a couple of days or weeks, and they file what’s called a hospital lien on the deed books and record in your county.

What does that do? Well, they know if you’re in a wreck, you’re probably going to get a lawyer. You’re definitely going to get some sort of settlement, and it says under the law that the lawyer or you has to deal with that hospital lien out of your settlement in order to get rid of the lien and not have legal action against you.

They’re not telling you the full story, and it’s all because they can make more money, especially when you have a lawyer involved by filing a hospital lien and having you deal with it, then taking the health insurance rate.

We’ve had multiple clients being told that they’re not allowed by law to take health insurance and that when you’re in a wreck, they have to bill it to the at-fault party, which is an absolute lie. They’ve come up with other different scams and schemes to tell patients that they can’t take your health insurance. They’ll even take the card, not tell you they’re not going to run it, and then file a hospital lien.

I first learned of this in a case I had a couple of years ago when a client had been in a really bad wreck. She initially didn’t hire a lawyer for about 6-8 months after the wreck, meaning I wasn’t able to deal with this on the front end. It already happened.

She was told that it’s against the law to take her health insurance and that the at-fault party insurance will pay for it. She thought that made sense.

It was a $16,000 bill when we finally get her case settled. I didn’t know all that had occurred, though her health insurance covered it. We get a settlement, and we’ve got a $16,000 hospital lien by law I have to deal with as her lawyer before I can give her a dime of her settlement money.

She had health insurance. Why wasn’t health insurance used?

That’s when I was told it’s against the law to do that. So, I immediately got on the phone with the hospital’s lawyer. He was shocked to hear that this was happening obviously against the law and we were able to get it resolved, but it still didn’t get paid by health insurance.

Why? Because at that point it’s too late. They hadn’t submitted it to health insurance in time, and health insurance is off the hook.

What Are Your Rights?

You absolutely have a right to have your health insurance used and if they do not use your health insurance, tell them they need to transport you somewhere else and that your health insurance needs to pay for this bill.

Do not fall for the scheme. You want the bill covered by your health insurance and make sure that it is applied.

Make sure to ask “Did you build this to my health insurance,” and you have to double and triple check that it’s been done correctly and not a big scam. Unfortunately, it’s been done by all the big hospitals around here, and I’ve got multiple clients that have fallen victim to this.

Can A Personal Injury Affect Your Employment?

If you’re unexpectedly and severely injured in an accident, it may take you a number of weeks – and maybe even months – to recuperate.

Particularly if you’ve been catastrophically injured or temporarily disabled, and if you need more than several weeks to heal, for some people working for some employers, your employment could be at stake.

After a serious injury, what are your employment rights? What are the rights of employers? How can you protect your employment if you require a little extra time to recover from your injuries? How can a car accident lawyer help?

When a Severe Injury Happens, What Are the Priorities?

When a serious accident happens, seeking medical treatment is the top priority. If you’re the person who’s been injured, after you’ve been seen by a physician or another healthcare provider, the next thing you must do is to retain legal counsel that you trust.

If you’re in the Atlanta area, as quickly as possible after your medical exam, arrange to speak about your rights and options with an experienced Atlanta personal injury lawyer.

A good injury attorney will provide sound legal advice and dedicated representation, will negotiate aggressively for your complete compensation, and will work diligently to resolve your case in a manner that’s just and fair to everyone who’s involved.

What Might Happen After You Sustain a Long-term Injury?

Of course, no amount of cash can compensate for certain losses that result from severe, long-term injuries, such as:

- Defaulting on medical bills could lead to foreclosure on your home, repossession of your car or truck, and/or bankruptcy.

- The emotional and financial pressures arising from a severe long-term injury can result in a separation or a divorce.

- Sometimes, employers can be impatient, and if your recovery takes too long, you could be replaced at work, or your position could even be eliminated.

When someone is employed in Georgia with no employment contract, it is an “at-will” employment arrangement.

Either the employee or the employer may terminate the arrangement “at-will,” provided that the employee is not fired for a reason that’s illegal – like discrimination or retaliation.

Can You Take Action to Protect Your Job After an Injury?

The right of employers to fire employees at-will is the reason why you must act to protect your job if you suffer any illness or injury that will keep you from work for more than just a few days.

The law in Georgia will be on your side.

You’ll need to know your employment rights and the pertinent federal and state employment laws. Having the advice and insights of an injury attorney will be imperative.

How Can the “FMLA” Help You?

Many injury victims in our state have employment protection through the FMLA – the Family and Medical Leave Act of 1993. It requires employers who have at least fifty employees to offer employment-protected, unpaid leave for specific family and medical reasons.

The FMLA provides qualified employees with unpaid leave for medical reasons for as long as twelve weeks.

After the leave period, the employee must be allowed to return to work, or the employer has to provide comparable employment with similar pay and similar advancement prospects.

If your employer eliminates your position or replaces you when you are legally on FMLA leave – and does not offer you a comparable position – the employer has probably violated federal law.

You’ll need to speak regarding your situation with a personal injury lawyer who also has employment law experience.

Can Taking Leave Result in Someone’s Termination?

If you’ve properly completed the paperwork and you’ve made the necessary notifications, you can’t be terminated for legally taking leave. That would be a wrongful termination, and it would be illegal under federal law.

In Georgia, the targets of wrongful termination have the right to take legal action.

If your wrongful termination lawsuit succeeds, you can be returned to your job, you may be eligible for back pay, and in some instances, you may be awarded punitive damages and/or legal fees.

If you need time off work to recover from an illness or injury, and if you work for an employer with at least fifty employees, tell your supervisor or HR department that you need to take unpaid FMLA leave.

When you request FMLA leave, your employer has the right to ask for a statement from your healthcare provider regarding your medical condition.

Does Georgia Require Employers to Provide Paid Leave?

No mandatory sick leave is required by Georgia law. However, many employers in Georgia voluntarily provide paid leave.

Employees need to be sure that they understand the leave policies of their employers and that they comply with those policies.

If a dispute with your employer emerges over sick leave, you should be able to show that you complied with the employer’s leave policies, rules, and deadlines.

What is Your Recourse if You’ve Been Injured?

If you’re injured by another person’s negligence in this state – in a vehicle crash, in a medical malpractice incident, or in any other scenario – you are probably entitled by law to complete reimbursement for your ongoing medical costs, lost income, and more.

Those injured by negligence will need advice and representation from a skilled personal injury lawyer. Your lawyer will aggressively negotiate for your compensation and take your claim to trial if negotiations do not lead quickly to a fair and just settlement.

However – and this is important for every employed person in Georgia to understand – if you are injured at work or in the “course and scope” of your employment, you won’t be able to sue your employer.

How Does Workers’ Compensation Work in Georgia?

Employees injured on the job can’t sue their employers in Georgia, but they will almost always be eligible to receive workers’ compensation payments.

Workers’ comp in this state pays medical bills for job-related injuries, temporary wage-replacement benefits, and – for the eligible – permanent partial disability benefits.

Although you can’t sue an employer over a job-related personal injury, if that injury was caused by someone else – not your colleague or employer – you can probably pursue a “third-party” personal injury claim with your lawyer’s help.

Why Will You Need a Lawyer’s Help if You’re Injured?

When employment law and personal injury law intersect in the same case, the legal issues can quickly become complicated.

If you are injured at your workplace – or anywhere in Georgia because another person was negligent – you’ll need legal advice you can trust, and you’ll need it immediately.

If your health and your job are both at risk, don’t wait. You must get the legal help that you need – right away. That is your right.

What Are The Motorcycle Helmet Laws In Texas?

I will talk about a heated debate I recently had about the ever-controversial helmet issue. The other party told me that he thought the Georgia helmet law ought to go to the Texas model and perhaps be modified a little bit.

First, let me tell you the Texas model, and then I’ll tell you my response as an Atlanta motorcycle accident attorney.

What Are The Motorcycle Helmet Laws In Texas?

Texas helmet law says anyone under 21 has to wear DOT-approved motorcycle helmets. If you’re over 21, you don’t have to wear a helmet, and therefore it’s not against the law to not wear one if you do one of two things: you take a safety course, or you have medical insurance of at least $10,000.

So that was his response, “Hey, we ought to make it free will and require riders to have a certain amount of coverage, and then they can make the choice,” and I understand that. Being probably more of a libertarian politically, I don’t want the government telling me what to do, so I get that angle.

But, for me in the cases that I get year in and year out and just hearing in general about all of these wrecks that are happening because the general public is not looking out for motorcycle riders, I think you’ve got to put free will and personal decisions aside and that the law is good the way it is. You’ve got to wear a helmet in Atlanta. You’ve got to be safe because you never know when you may be the one that gets hit by somebody.

What Does Data Say About the Effective of Helmet Laws By State?

If you know me at this point by watching some of these videos, you know that I love empirical data. So, I gave him some empirical data as my response and said, “Look I get it, but here’s what the empirical data shows in states where they repealed helmet laws, similar to Texas or even much more lenient than Texas.”

The study showed that afterward, traumatic brain injuries increased by 60 percent or more, deaths increased by 30% or more, and this is in the motorcycle riders themselves. One study from 2015 showed that if helmets had been worn in fatal accidents, 700 and some odd individuals in America would not be dead, and that kind of struck me.

That’s 700 lives, just because they didn’t want to wear a helmet, and to me, at the end of the day I look at that, and I say, “Come on. I get it, you want to have your own choice. I understand that, but we must also recognize that riding a bike is a dangerous hobby. Not because of us. Not because of us riders out there, but because of other people, and we can’t be sure that we’re not going to be the next one that is knocked off our bike, and you’ve got to have that helmet to protect yourself.”

In the end, looking at the data suggests that these helmet laws are there to ultimately protect the rider and the empirical data backs that up; it’s just absolutely necessary that we wear the correct helmet, not just any helmet but the correct helmet.

Should We Change the Georgia Helmet Law?

Do you think we ought to go to the Texas model and put the onus on the biker that you’re going to have to get enough insurance to cover injuries that you sustain, even if it’s by a third party because you’re not wearing a helmet? Or should we keep the law where we are, or maybe some variation of that?

How To Take Care Of Your Bike During The Winter

It’s the end of the riding season, and I know a lot of you like to put your bike up for the winter. Therefore, my Cumming motorcycle accident law firm wants to provide information on how best to winterize your bike.

There are two ways to do it. You’ve got the minimum that you ought to do, and you’ve got the “Cadillac way,” as I call it, to winterize your bike.

What Is The Minimum Care You Should Give Your Bike?

First off, don’t just put it in the garage, kickstand down, throw a sheet over it, and be done with it for the season. You’re going to get to spring and probably have a couple of issues if you do that.

There are two things you’ve got to do for the minimum proper winterization of your bike. It’s looking at two things, one, the battery, and two, your full fuel system.

Checking The Fuel System

Most of you have fuel injection systems on your bikes, and if you do, all you have to do with your fuel system is top it off with gas, put in some fuel stabilizer in, you’re fine. However, it’s important to fill that tank to the top with gas and then the stabilizer that you’re going to put in.

Why? Because that lets less air into the gas tank and ages the gas, which can cause you problems once you start the bike up in the spring.

What To Do With The Battery

The second is the battery. If you’ve got an ion battery in a bike, then all you need to do is unplug the negative terminal, and you’re good to go.

Otherwise, you need to use a smart battery charger and hook that up, so it changes over time as the battery drains down while it’s sitting. What you don’t want to do is do nothing to your battery. Then, you start the season a couple of months from now, and your battery’s been drained down.

What About The “Cadillac Way?”

First, you want to wash and detail the motorcycle fully. We’re talking wash it, wax it, wipe down all the chrome. This will keep deterioration from happening.

Also, for all of the plastic parts, you want to wipe it down with a good plastic cleaner. Get it nice and detailed before you put a sheet over it.

Then, what you want to do is store it on blocks, so it’s up, so you’re dealing with the tire. If you just let it sit with pressure on those tires, then you’re going to have warped tires when you start it up in the spring.

Personally, I use 2×4’s. If you’ve got a list system that’s great, use that, lift the bike up and put a sheet down underneath it. That keeps dust from coming up as well. And then obviously, add a sheet over top of it.

What About The Oil?

But, how do you deal with the oil? Well, if you’re more than halfway to a new oil change at the time that you’re going to put it up for the season, then go ahead and change the oil.

If you’re more than halfway to a new oil change, then you’re fine. What you want to do is just like with the fuel, you want to top off the oil to keep air from getting in there.

Some Other Tips For Protecting Your Bike During The Winter Months

You want to block your muffler in the airbox inlet with heavy plastic in a rubber band or zip ties. That’s going to keep critters from getting in there, dust, etc.

Watch those tires. You want first to have them fully inflated to the proper level. Again, get it up on blocks, even makeshift blocks with 2×4’s or cement blocks.

Get those tires up off the ground when it’s going to be sitting for several months. That way you don’t have worked and worn out tires.

These tips will give you the ability to start the new season next year, 2019 off with a bang with a beautiful bike. Everything’s ready to roll. You’re not going to have to worry about fixing it up, changing a battery, having problems with the engine intake, etc. Make sure to follow these tips to avoid accidents.